Profiting with the 6-12 SMA Trading Strategy

Introduction

In the ever-evolving world of financial markets, traders seek strategies that provide both simplicity and effectiveness. One such strategy, the 6-12 Simple Moving Average (SMA) trading strategy, has earned its place among traders for its ability to identify trends. In this article, we will delve into the intricacies of the 6-12 SMA trading strategy, complete with candlestick chart images, and provide real-world examples of both successful and unsuccessful trades.

Understanding the 6-12 SMA Trading Strategy

The 6-12 SMA trading strategy utilizes two Simple Moving Averages (SMAs) with different timeframes:

- 6-Period SMA: This is a short-term SMA, providing a quicker response to price changes. It helps traders identify short-term trends.

- 12-Period SMA: Slightly longer-term, the 12-period SMA offers a more balanced view of the market, capturing mid-term trends.

Trading Signals

The 6-12 SMA trading strategy generates signals based on the relationship between these two moving averages. This strategy can be applied on daily or lower timeframes:

Golden Cross (Bullish Signal):

- When the 6-period SMA crosses above the 12-period SMA, it triggers a bullish signal.

- This indicates that the short-term trend is potentially shifting to the upside, suggesting a buying opportunity.

Death Cross (Bearish Signal):

- Conversely, when the 6-period SMA crosses below the 12-period SMA, it generates a bearish signal.

- This suggests that the short-term trend is possibly shifting to the downside, indicating a selling opportunity.

Candlestick Chart Examples

1. Winning Trade Example:

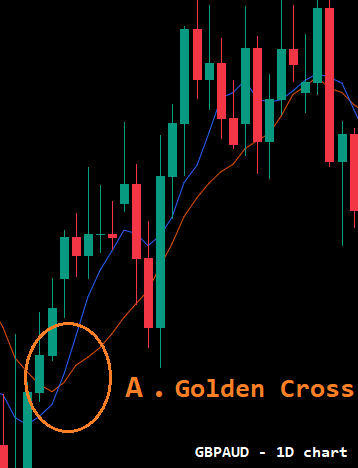

Let’s explore a golden cross winning trade using the 6-12 SMA strategy:

In this illustration:

- The blue line represents the 6-period SMA.

- The orange line represents the 12-period SMA.

- The candlestick chart displays price movements.

Around the point marked “A,” we observe a golden cross, where the 6-period SMA (blue) crosses above the 12-period SMA (orange). This signals a potential uptrend. As the trend develops, the price steadily rises, affirming the validity of the golden cross signal, and leading to a profitable trade.

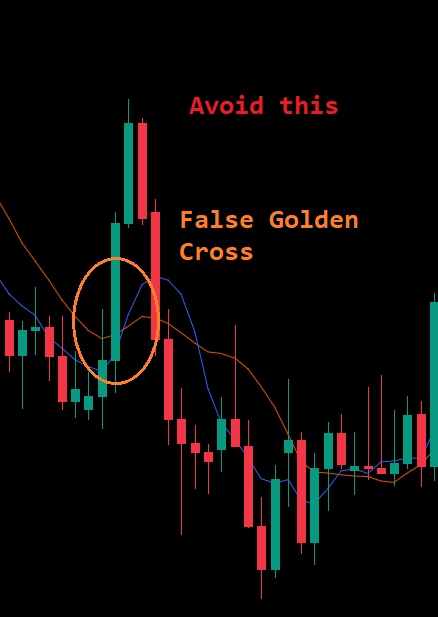

One important point to look for is the overall trend. In our example above the GBPAUD pair is in up trend. You can establish the overall trend by looking at either a higher timeframe chart or higher SMA (example SMA 20). This will help support your decision to enter a trade. Here is an example where you will lose a trade if you try to enter a trade looking at golden cross when the market is in down trend.

Here the over trend is a down trend. Although the blue line is crossing the orange SM A line you will lose this trade because the momentum is downwards. Avoid this.

2. Losing Trade Example:

Now, let’s consider a losing trade using the same strategy:

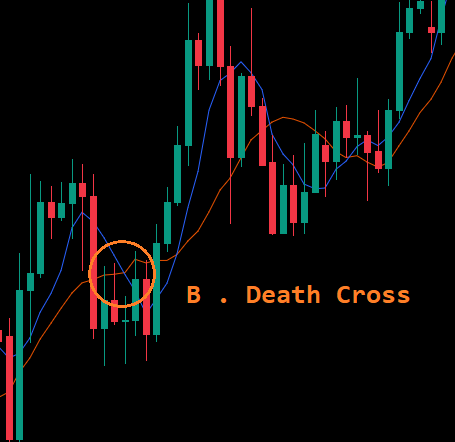

In this scenario:

- The blue line represents the 6-period SMA.

- The orange line represents the 12-period SMA.

- The candlestick chart visualizes price movements.

Around the point marked “B,” we witness a death cross, as the 6-period SMA (blue) crosses below the 12-period SMA (orange). This suggests a potential downtrend. However, the price does not follow the expected path. Instead, it briefly reverses and surges before resuming its downward movement, resulting in a losing trade. As explained in the previous example you see a death cross setup for a short trade but the overall trend here is upward. You have to avoid this setup.

Conclusion

The 6-12 SMA trading strategy is a valuable tool for traders seeking to capture short and mid-term trends. By analyzing the relationship between these two moving averages, traders can identify potential entry and exit points.

However, as demonstrated by our examples, no trading strategy is infallible. Successful trading requires not only a solid strategy but also prudent risk management, discipline, and the ability to adapt to changing market conditions. It’s important to combine the 6-12 SMA strategy with thorough research and spent time to establish a perfect favourable trade setup. There are many tools and apps available that help you identify such setups. You may use one of them but never fully depend on such tools. Use them only to identify setups. Do your own study of the setup before putting your money on the trade.

Here is one such tool that will help you correctly identify such trade setups.