Mastering Short-Term Trading with Bollinger Bands: Strategies for Success

Introduction

Having a well-defined strategy can make all the difference. The Bollinger Bands short-term trading strategy is a popular choice among traders due to its versatility and effectiveness in capturing price movements. In this article, we’ll explore the Bollinger Bands strategy in detail with candlestick diagrams.

Understanding the Bollinger Bands Short-Term Trading Strategy

The Bollinger Bands strategy is centered around Bollinger Bands, which consist of three components:

- Middle Band (SMA): This is a Simple Moving Average typically calculated over a 20-day period. It represents the mean or average price.

- Upper Band: This is calculated by adding two times the standard deviation of the price to the middle band. It forms the upper limit of the Bollinger Bands.

- Lower Band: This is calculated by subtracting two times the standard deviation of the price from the middle band. It forms the lower limit of the Bollinger Bands.

Trading Signals

The Bollinger Bands strategy primarily uses the relationship between price and the bands to generate trading signals:

Bollinger Squeeze (Volatility Contraction):

- When the price is trading within a narrow range, and the bands are close together, it indicates low volatility.

- This is known as a “squeeze” and suggests that a significant price movement may be imminent.

- Traders look for the breakout of price from the squeeze as a potential trading opportunity.

Bollinger Breakout:

- When the price breaks above the upper band, it may signal a bullish (buy) opportunity.

- Conversely, when the price breaks below the lower band, it may signal a bearish (sell) opportunity.

Bollinger SMA Cross:

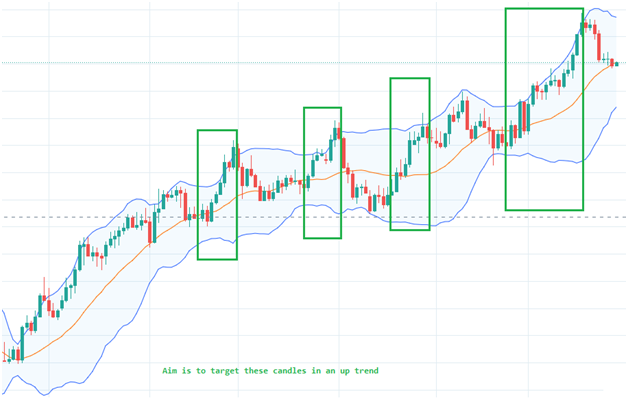

The above two methods are the most commonly utilized Bollinger band strategies. However, depending solely on these strategies may not suffice. Therefore, we enhance Bollinger band techniques to further improve the odds of success. Upon close examination of Bollinger bands, you’ll notice a recurring tendency in price action, shifting from one band to the other. Our approach begins by establishing an underlying trend, which must either be a short-term uptrend or a downtrend. In the case of an uptrend, we search for instances where the candle opens below the SMA line and closes above it, presenting a potential trading entry opportunity. Subsequently, we patiently wait for the price action to reach the upper band, signaling our exit from the trade.

The green windows in the image below show the candles that we are targetting in the Bollinger SMA Cross strategy. In an uptrend you can mix the bollinger breakout and bollinger SMA cross to improve the number of trades. You may use our free tool that helps identify these trading setups.

Conclusion

The Bollinger Bands short-term trading strategy is a valuable tool for traders seeking to capture short-term price movements. By monitoring the relationship between price and the bands, traders can identify potential entry and exit points. However, as demonstrated in our examples, trading is inherently risky, and no strategy guarantees success every time. It’s crucial for traders to combine the Bollinger Bands strategy with other forms of analysis, risk management, and a robust trading plan.

There are many tools and apps available that help you identify such setups. You may use one of them but never fully depend on such tools. Use them only to identify setups. Do your own study of the setup before putting your money on the trade.